Ira Simple Contribution Limits 2025

Ira Simple Contribution Limits 2025. Those 50 and older can contribute an extra $1,000 for a total of $8,000. The maximum contribution limit for both types of.

If less, your taxable compensation for the year. Updated on january 28, 2025.

Beginning In 2025, The Ira Contribution Limit Is Increased To $7,000 ($8,000 For Individuals Age 50 Or Older) From $6,500 ($7,500 For Individuals Age 50 Or Older).

Get any financial question answered.

The Simple Ira And Simple 401 (K) Contribution Limits Will Increase From $15,500 In 2023 To $16,000 In 2025.

$8,000 if you’re age 50 or older.

Contribution Limits Employees Can Put In As Much As $23,000 In 401(K) In 2025 ($30,500 For Those Aged 50 Or Older).

Images References :

Source: www.advantaira.com

Source: www.advantaira.com

2025 Contribution Limits Announced by the IRS, If less, your taxable compensation for the year. The contribution limit doesn’t apply to transfers.

Source: janayeqjuanita.pages.dev

Source: janayeqjuanita.pages.dev

Simple Ira Contribution Limits For 2025 Joyce Lorilyn, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. That's up from the 2023 limit of $15,500.

Source: carlyqnikolia.pages.dev

Source: carlyqnikolia.pages.dev

2025 Ira Contribution Limits Over 50 Emelia, $6,000 ($7,000 if you're age 50 or older), or. Get any financial question answered.

Source: www.usatoday.com

Source: www.usatoday.com

SIMPLE IRA Contribution Limits for 2025, Family coverage will increase from $7,750 to $8,300. For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023.

Source: debrabaloisia.pages.dev

Source: debrabaloisia.pages.dev

401k Limits 2025 Irs Bren Marlie, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. For 2025, the ira contribution limit is $7,000 for those under 50.

Source: elanaqchristabel.pages.dev

Source: elanaqchristabel.pages.dev

Simple Ira Calculator 2025 Natty Viviana, Family coverage will increase from $7,750 to $8,300. $6,000 ($7,000 if you're age 50 or older), or.

Source: choosegoldira.com

Source: choosegoldira.com

ira contribution limits 2022 Choosing Your Gold IRA, In 2020, the maximum contribution limit for simple iras increased $500 from 2019. Contribution limits employees can put in as much as $23,000 in 401(k) in 2025 ($30,500 for those aged 50 or older).

Source: www.carboncollective.co

Source: www.carboncollective.co

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits, The limits are adjusted annually to account for inflation and other economic factors. $6,500 ($7,500 if you're age 50 or older), or.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2025 Contribution Limit Chart, The contribution limit doesn’t apply to transfers. In 2023, simple iras allow for employee contributions up to $15,500 annually ($19,000 for those 50 or older);

Source: skloff.com

Source: skloff.com

IRA Contribution and Limits for 2023 and 2025 Skloff Financial, For both iras, investors can put in a total amount of $7,000 in 2025 ($8,000 if. The contribution limit doesn’t apply to transfers.

View Ira Contribution Limits And Deadlines To Learn More.

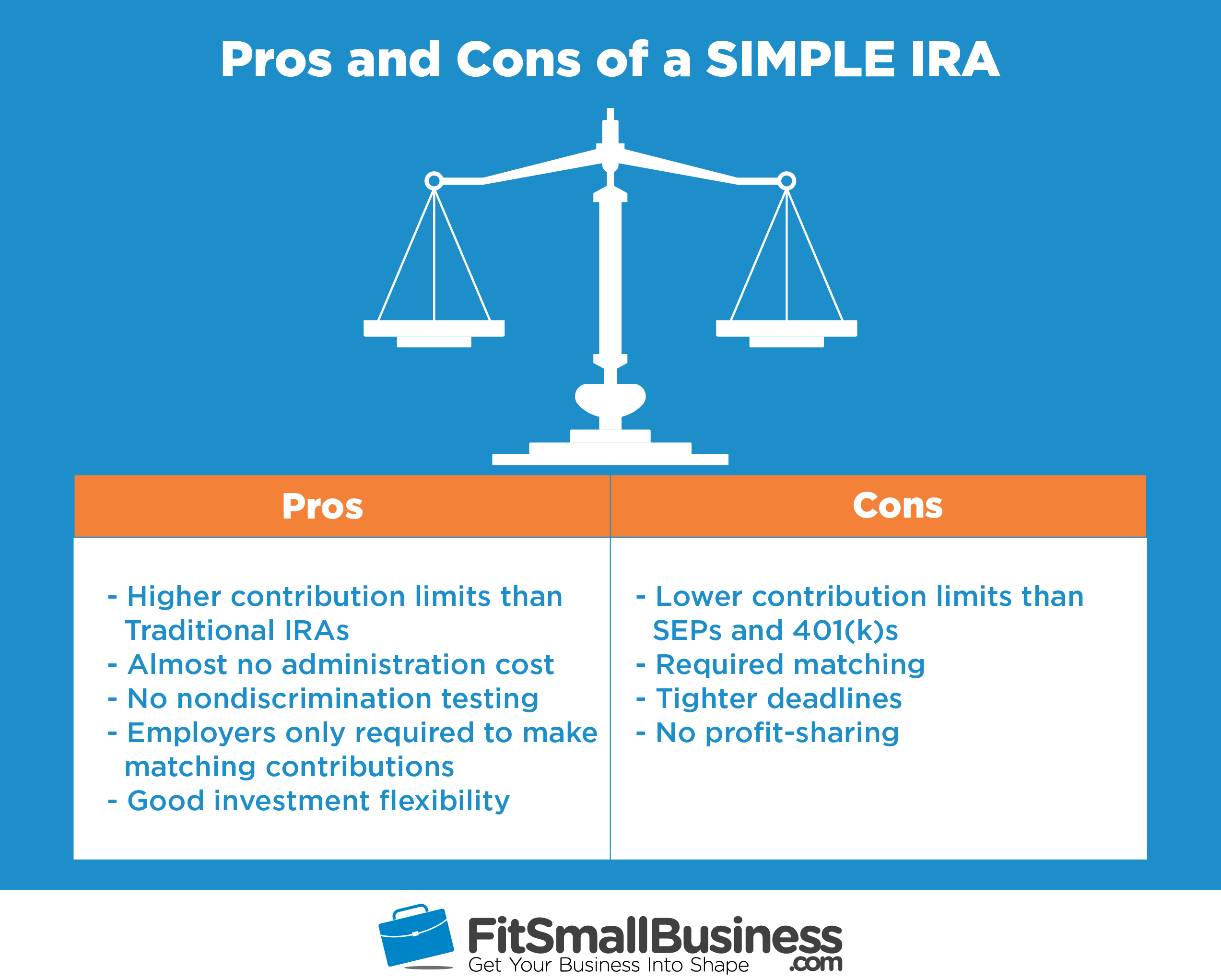

Simple ira savings incentive match plan for employees—or simple ira —is a plan for businesses with 100 or fewer employees that might not have the resources to handle the administrative duties.

The Lesser Of (A) $7,000 For 2025 ($6,500 For 2023) Or (B) Your Taxable Compensation For The Year.

For 2025, if you are married and filing jointly, each spouse can make a maximum roth ira contribution of $7,000 if they have an agi (adjusted gross income) of less than $230,000.